Real Property Use

Both your old and new properties must qualify as investment or business use. If both properties pass this test, you can exchange nearly any type of real estate.

|

|

IRC § 1031 Exchanges

Epic One Real Estate focuses on increasing our clients Net Worth. We understand that the key to a successful real estate transaction is maximizing our client's Net Proceeds from each transaction, enabling our client's to have greater purchasing power. Epic One Real Estate has guided our clients through many successful 1031 Property Exchanges and we have a network of experts ready to set you up for an exchange under IRS guidelines. What does this mean for you? You can avoid thousands of dollars in Capital Gains Tax and net more per transaction.

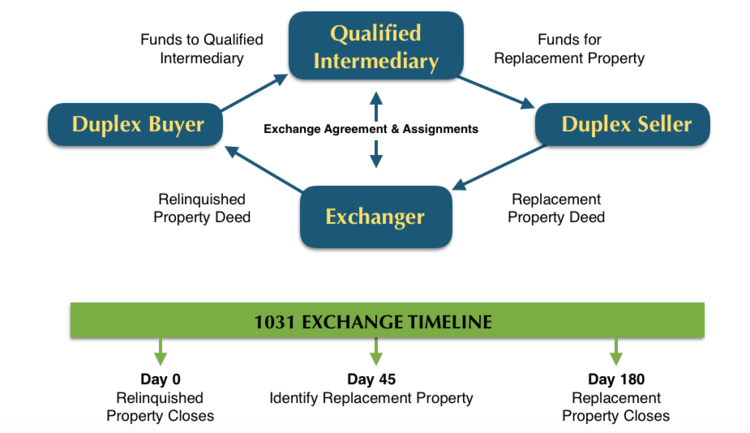

The IRS rules for conducting an IRC 1031 Exchange is exact with several timeline deadlines. Epic One Real Estate utilizes a proven team of experts to arrange properly executed IRC 1031 exchanges. Our managing broker directs, coordinates, and tracks progress of key date deadlines and milestones of all professional service providers during exchanges, including lenders, loan brokers, accomodators, escrow officers, and all other professionals critically involved in each exchange transaction.

Both your old and new properties must qualify as investment or business use. If both properties pass this test, you can exchange nearly any type of real estate.

You have 45 days from the closing of your sale to list the properties you may want to buy. There are no exceptions to the deadline..

From the sale closing date, you have 180 days to close on the purchase of one or more properties from the 45-day list. Again, there are no exceptions to this deadline.

The IRS mandates that you use a QI to prepare the legal documents for your exchange. Because the QI must be independent, it cannot be your friend, employee, broker, or even your accountant or attorney. The QI also holds your money, so that you do not have access to it.

You must purchase and take title to your new property exactly as you held title to your old property.

To defer all of your capital gain tax, you must buy a property equal or higher in value than the one you sold. Also, you must reinvest all of the cash proceeds from your sale. The investor must always acquire the replacement property with equal or greater debt. If the exchanger does not acquire a replacement property with equal or greater amount of debt, the IRS deems it as reduction in debt and a benefit accruing to the exchanger, hence taxable.

The exception to this rule is that any decrease in debt of the replacement property(ies) be offset by adding equivalent cash to the replacement property purchase.

Data by San Diego MLS, Inc. and other providers. This information is deemed reliable but not guaranteed. You should rely on this information only to decide whether or not to further investigate a particular property. BEFORE MAKING ANY OTHER DECISION, YOU SHOULD PERSONALLY INVESTIGATE THE FACTS (e.g. square footage and lot size) with the assistance of an appropriate professional. You may use this information only to identify properties you may be interested in investigating further. All uses except for personal, non-commercial use in accordance with the foregoing purpose are prohibited. Redistribution or copying of this information, any photographs or video tours is strictly prohibited. This information is derived from the Internet Data Exchange (IDX) service provided by San Diego MLS, Inc. Displayed property listings may be held by a brokerage firm other than the broker and/or agent responsible for this display. The information and any photographs and video tours and the compilation from which they are derived is protected by copyright. Compilation © 2024 San Diego MLS, Inc.

Copyright © 2003-2024 Epic One Real Estate, Pacific Asset Investment Corporation. All rights reserved.